What a last couple of weeks it has been for Walton International – the Alberta Securities Commission suspended Walton’s registration which prohibits them from selling any more of their investments. And then they hired Ernst & Young to take them through the CCAA process in an attempt to re-organize their debt. This sounds almost identical as the League Assets story we discussed last summer in this blog post. One can conclude the Walton matter will have the same ending! How can a company make hundreds of millions of dollars selling land be broke after 25+ years of being in business? Rumor on the street is the company is being gutted and those (at the top) have already cashed out their millions…

WAS THIS ALL PREDICTABLE?

Back a few years ago I came across a Sales Representative that worked at Walton International at a Calgary Flames hockey game. After chatting for a few minutes he suggested I look at his investment opportunity – it was a parcel of land down by Spruce Meadows (in the southern tip of Calgary). Although I was not interested in the investment, I agreed to meet with him at his office a short while later.

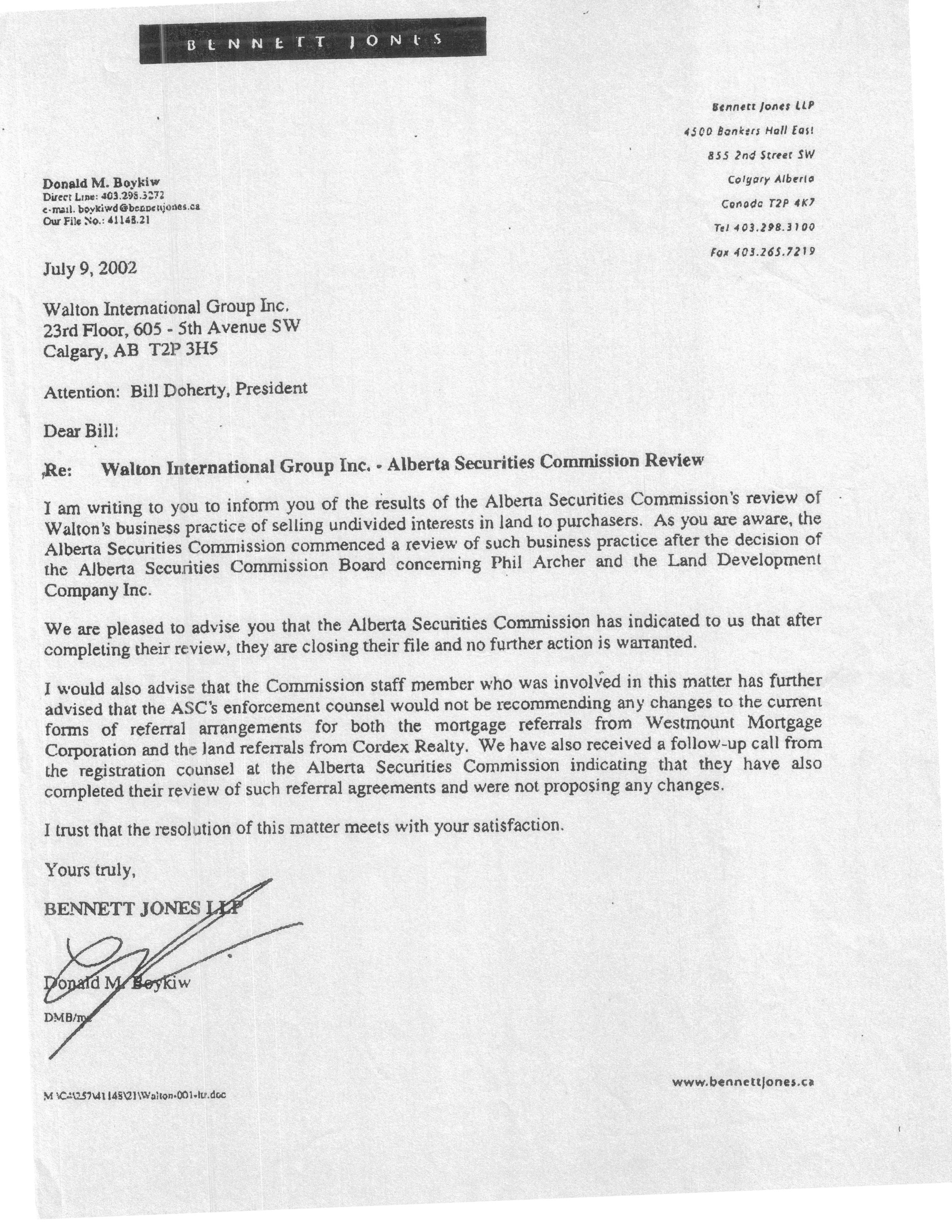

I remember their office being really nice and it seemed like they had a ton of staff. After receiving a brief sales pitch I was sent on my way with an envelope full of paperwork. Some time later, I opened the envelope and (as part of the package) discovered a letter from a lawyer named Donald Boykiw from the fancy Bennett Jones LLP law firm.

The letter is short and cuts to the point – it indicates that Boykiw is writing to inform Walton that the Alberta Securities Commission had reviewed Walton’s business practice of selling undivided interest in land to purchasers and that this review had been done as a result of sanctions against Walton’s prime competition in Alberta land banking. Boykiw goes on to state, “I would also advise that the Commission staff member who was involved in this matter has further advised that the ASC’s enforcement counsel would not be recommending any changes to the current forms of referral arrangements for both the mortgage referrals from Westmount Mortgage Corporation and the land referrals from Cordex Realty. We have also received a follow-up call from the registration counsel at the Alberta Securities Commission indicating that they ave also completed their review of such referral agreements and were not proposing any changes.” A copy of the letter:

The significance of this letter is simple – Walton International’s business model sees them allegedly buying farm land for as little as $400 per acre and turn around only days later and sell it for up to 7000% increases to investors from all over the World – and the gang down at the ASC gave them a clean bill of health while sanctioning others in the same line of work. And don’t forget – this happened during Ralph Klein’s duration as Premier of Alberta who’s daughter physically worked at Walton’s head office.

For those people that do not know who Walton International are (or were) – they purported to be the largest land banker (and then later land developer) in the nation. They had many projects throughout Canada and the United States. They had come under fire in some circles for paying huge upfront commission to their sales people and for having lavish spending sprees on chartered boats and trips for Staff. In one instance, it was reported they had chartered a large ship and had the expensive Self-Help Guru Anthony Robbins as a guest to get their staff motivated to sell their product.

Facts are – may people have been reporting on Walton’s demise for years. A simple google search has found us endless reports from press from all over the World suggesting Walton’s business plan had some distinct cracks and was leaking severally. An article in the Ottawa Citizen from March 2013 suggests the land banking project in Ottawa was in trouble.

What happened in Singapore when they had several complaints about many Land Banking firms – even Walton International? Out comes the huge Public Relations wheel and they brought an entire news crew to see their operations in Canada….

https://www.youtube.com/watch?v=sTzJ_61nY54

This video is so biased towards Walton but comes across as some bi-partial news telecast – We wonder how much more they raised after this video made the rounds…

Would this all have been avoided IF the ASC had not given them that clean bill of health back in 2002 – that they used as a sales aid for their sales people??? Shame on the ASC! This story is going to be huge when the cards ALL come falling down – and this letter is going to be used in any case against the ASC! How are they going to be able to protect the Walton Investors when they are complicit in allowing Walton to exist – even going as far as giving legal advice that their sales people used to close the unexpected investors?

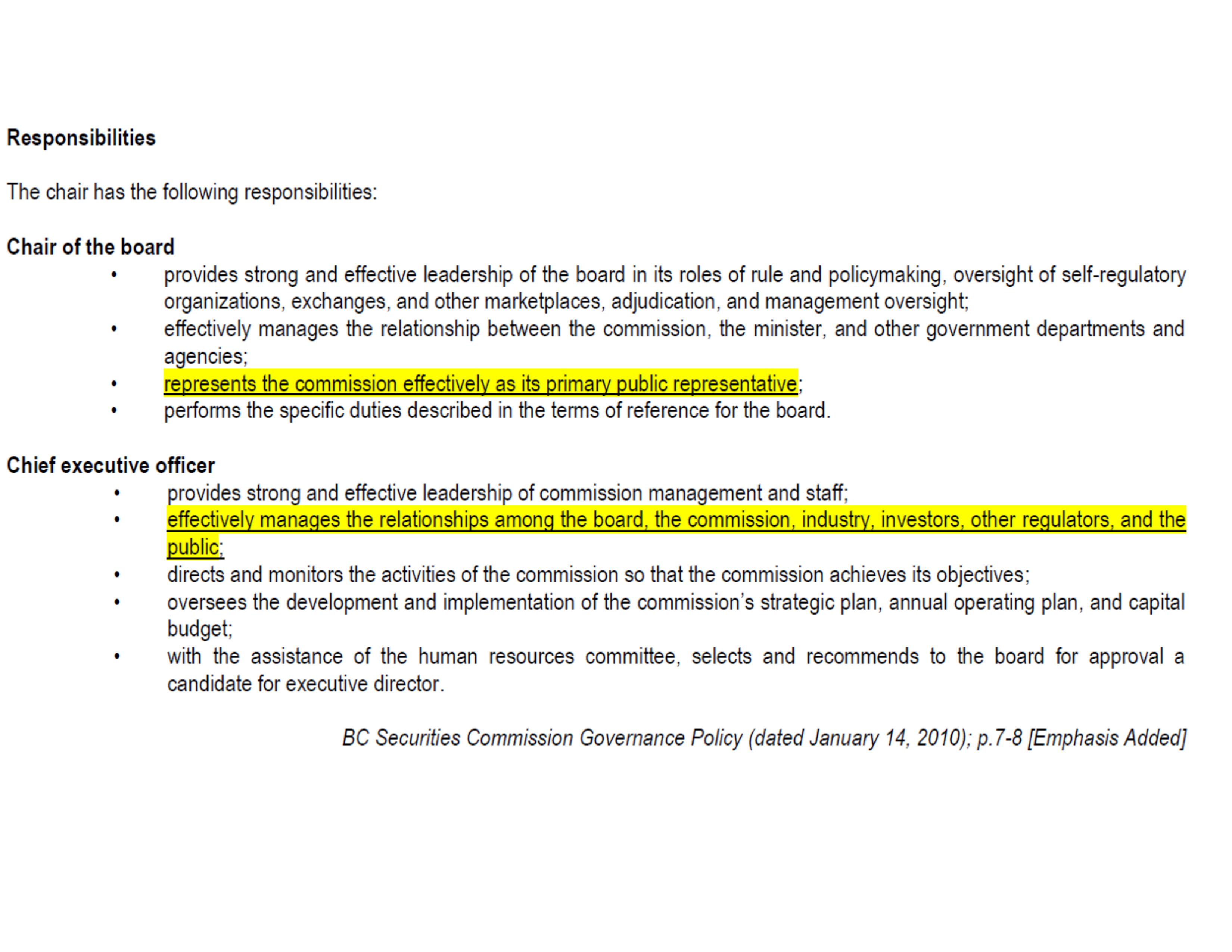

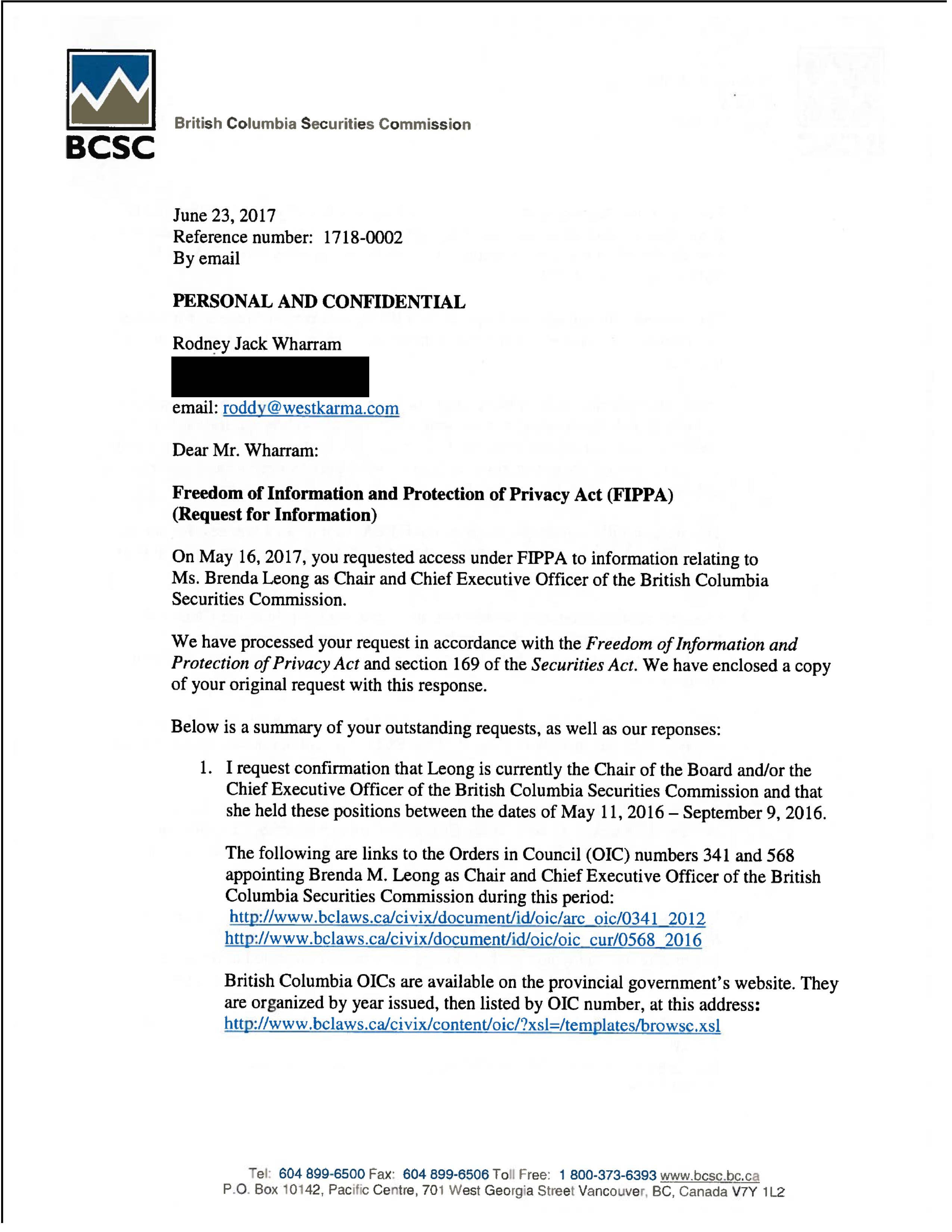

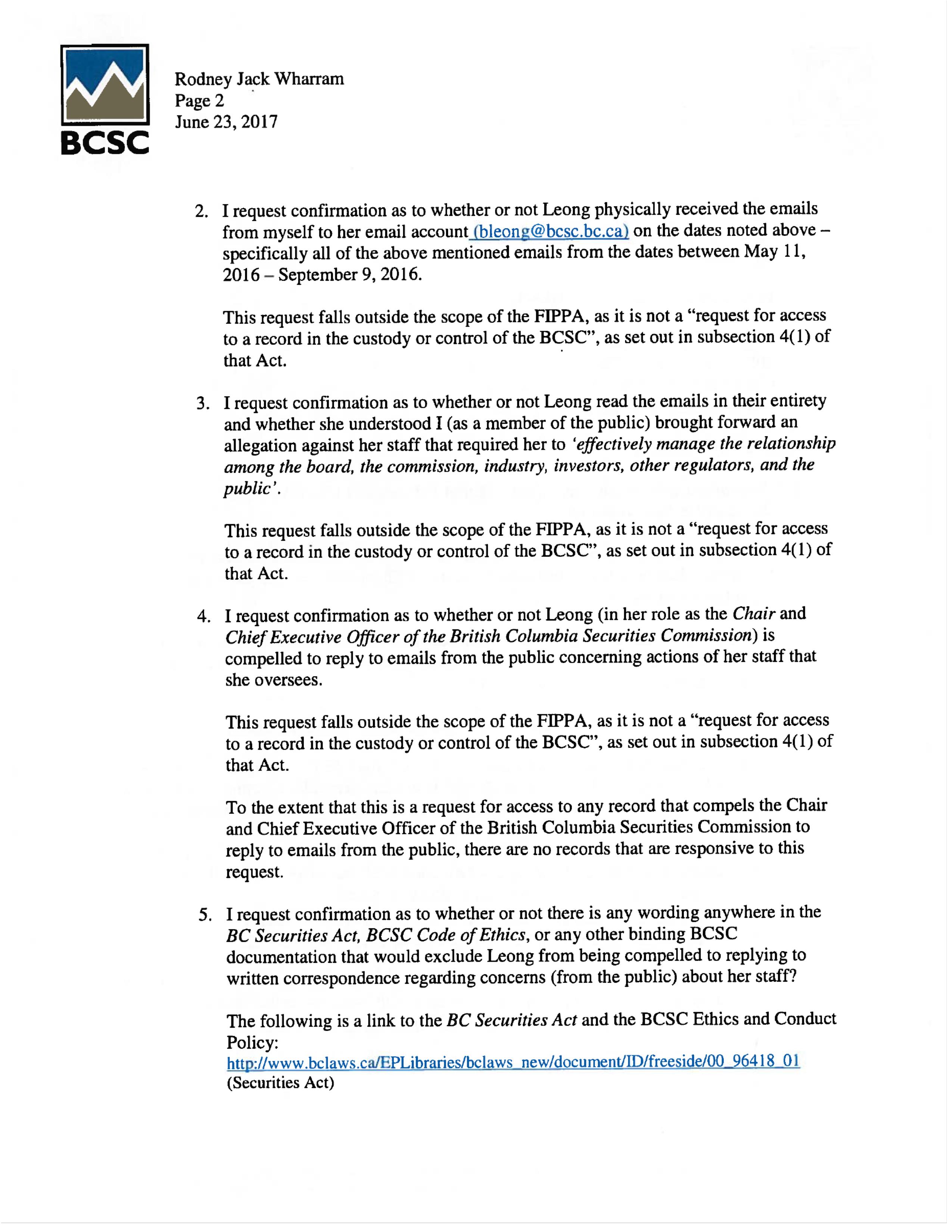

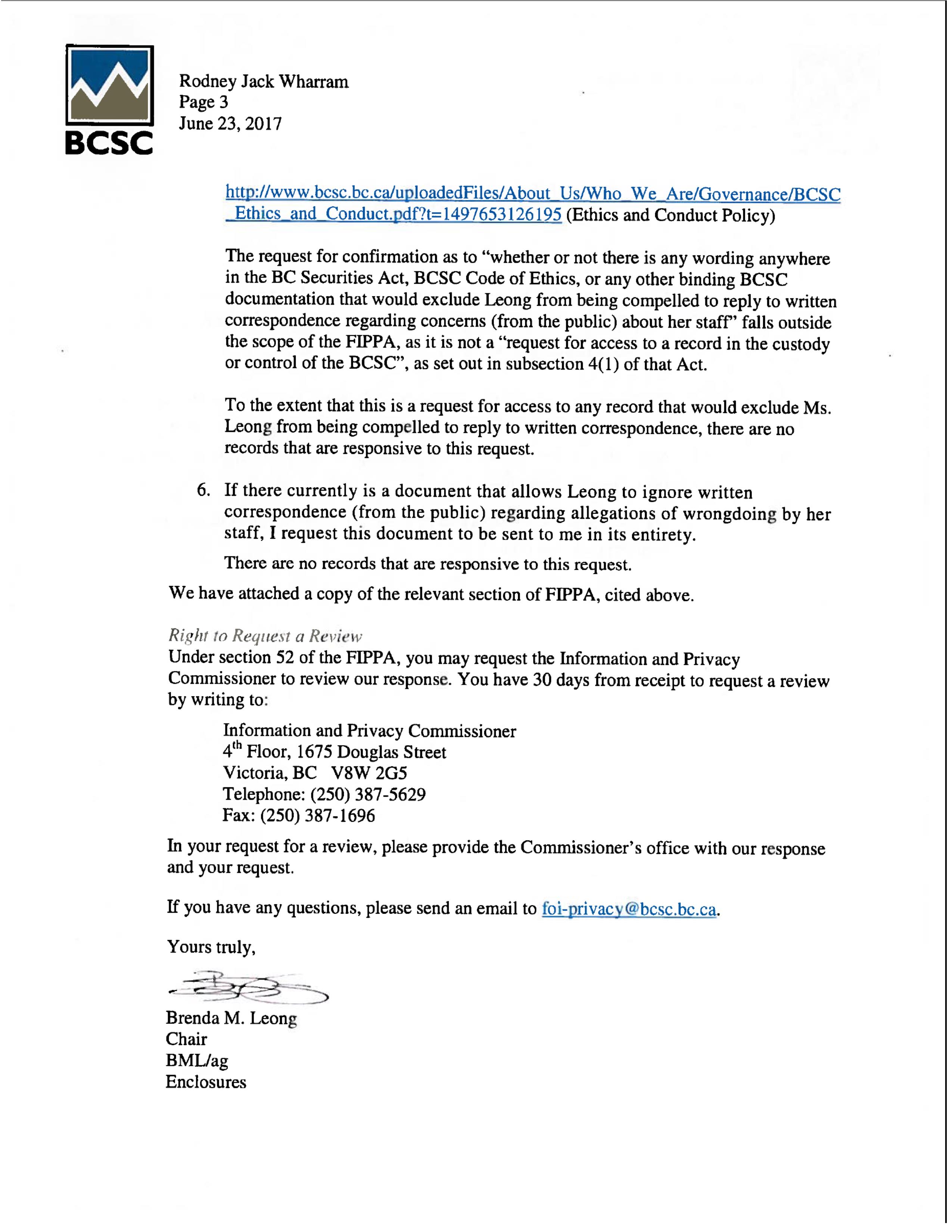

BCSC Chair Brenda Leong

BCSC Chair Brenda Leong