****PUBLISHED PREVIOUSLY****

On December 19, 2017, the whiny Canadian Securities Administrators (“CSA”) felt the need to issue a Press Release in regards to the media attention their failures are causing the good people and capital markets in Canada. Why now? Media is hammering them over their dismal record of allowing fraudsters in the capital markets to run wild with little to no recourse.

We here read over the release and find it very comical and so very inaccurate. Let’t take a closer look – Our comments will be in bold below…

December 19, 2017

Toronto – Over the past week, the Globe and Mail (Globe) has published multiple reports on enforcement in Canada’s capital markets. In response to this recent media commentary, the Canadian Securities Administrators (CSA) today issued the following statement:

The CSA, the council of securities regulators of Canada’s provinces and territories, coordinates and harmonizes regulation for the Canadian capital markets. CSA enforcement teams work to protect the integrity of our capital markets and strive for responsive, collaborative and effective enforcement of securities laws. While the vibrancy, depth and overall health of the Canadian capital markets have been internationally recognized, Canada, like all markets, has criminals who prey on the investing public. We do everything in our power to identify, investigate and prosecute those individuals. We are concerned with how these enforcement efforts have been mischaracterized and wish to highlight some specific issues with the Globe’s coverage:

(IT’S FUNNY – WHY DID JUST THE GLOBE AND MAIL ARTICLE GET THE ATTENTION OF THE CSA? THE VANCOUVER SUN AND PROVINCE HAVE BEEN HAMMERING THE BCSC THE LAST FEW WEEKS WITH ONLINE AND PRINT STORIES OUTLINING THE BCSC’S FAILURE TO COLLECT ON THE HUNDREDS OF MILLIONS OF DOLLARS THEY HAVE ISSUED IN FINES AND DISGORGEMENT ORDERS IN THE DECADE OR SO. MANY OTHERS HAVE BEEN OUTSPOKEN IN THE LAST FEW YEARS BUT ESSENTIALLY NOTHING FROM THE PRESS – WHY NOW?)

- Securities regulators do not have statutory authority to pursue criminal offences. In recognition, several securities regulators have strengthened their ability to address misconduct in the capital markets by developing partnerships with law enforcement. THE BCSC (AND I WOULD ASSUME ALL OF THE CANADIAN REGULATORS) ABSOLUTELY HAVE THE ABILITY TO PURSUE CRIMINAL OFFENCES. THE BCSC SPENT HUNDREDS OF THOUSANDS OF DOLLARS BRINGING IN A FANCY DIRECTOR OF ENFORCEMENT (THERESA MITCHELL-BANKS) AND HAVE (OR HAD) RCMP PHYSICALLY WORKING IN THEIR OFFICE. MITCHELL-BANKS WAS FIRED IN DECEMBER 2015 AND PAID A VERY HEALTHY SEVERANCE PACKAGE. FOR THE CSA TO SAY THEY DO NOT HAVE AUTHORITY TO PURSUE CRIMINAL CHARGES IS ABSURD. FACTS ARE THEY HAVE TO CHOOSE VERY EARLY ON IN AN INVESTIGATION AS TO WHETHER OR NOT THEY WANT TO PURSUE CRIMINAL CHARGES. AND THIS OPENS ANOTHER COMPLETELY DIFFERENT BURDEN OF PROOF NEEDED FOR CHARGES TO EVEN BE BROUGHT FORWARD.

- In order for securities regulators to access tools under the Criminal Code (e.g. power of arrest, ability to execute warrants), police officers must be seconded to securities commissions. More law enforcement resources are always welcome. AGAIN, WE HAVE IT ON VERY HIGH AUTHORITY THAT IN AS EARLY AS 2013 THERE WERE PHYSICALLY RCMP OFFICERS WORKING AT DESKS INSIDE THE BCSC. FURTHERMORE, THE RCMP HAVE PHYSICALLY BEEN PRESENT WHEN BCSC INVESTIGATORS HAVE ISSUED SUMMONS TO RESPONDENTS IN AT LEAST 3 MATTERS WE HAVE LOOKED INTO.

- Law enforcement is primarily responsible for investigating financial crime in Canada, and there is a dedicated unit of the RCMP (Integrated Market Enforcement Team) set up for this purpose. Despite the importance of law enforcement and their role in pursuing recidivists, the Globe chose not to seek comment from the RCMP or local law enforcement, nor did it include any statistical data from these agencies. THIS POINT IS REALLY CONFUSING – I THOUGHT IN THE POINTS ABOVE THEY INDICATED, “Securities regulators do not have statutory authority to pursue criminal offences” YET HERE THEY ARE INDICATING THEY HAVE ACCESS TO A DEDICATED UNIT OF THE RCMP? WHO WROTE THIS? WHAT A COMPLETE JOKE! MAYBE THE GLOBE AND MAIL DIDN’T SEEK COMMENT FROM THEM BECAUSE THEY ARE NOT DOING ANYTHING TO ASSIST AND INTERVIEWING THEM WOULD BE POINTLESS.

- Securities regulators work together to address misconduct in Canada’s capital markets, and the Globe was provided with multiple examples of these collaborative efforts. For example, several securities regulators have Statutory Reciprocal Order Provisions, which essentially means that an order issued by one regulator is automatically in effect within all jurisdictions with these provisions. It should be noted that these provisions were introduced specifically to curb inter-provincial/territorial wrongdoing by repeat offenders. GREAT! WHATS THE POINT? THE PROVISIONS ARE WONDERFUL AT GETTING FRAUDSTERS FROM MOVING PROVINCES. WHY WON’T THE BCSC TELL THE REPORTER FROM THE VANCOUVER SUN WHO IS IN CHARGE OF COLLECTING THE DEBTS AT THE BCSC? ONE COMMENT WE WILL MAKE HERE THOUGH IS HOW CAN A CANADIAN (UNDER THE CHARTER OF RIGHTS AND FREEDOMS) BE FOUND GUILTY IN A PROVINCE WITHOUT GETTING A HEARING AND A CHANCE TO DEFEND THEMSELVES? IT HAPPENS IN ALBERTA ON A DAILY BASIS SINCE JULY 2015. (CLICK HERE)

- Securities regulators can and do pursue jail time where they have the authority to do so. TECHNICALLY, ALL OF THE SECURITIES REGULATORS CAN PURSUE JAIL TIME WITH CRIMINAL INVESTIGATIONS AND CHARGES IN ALL CASES. THEY DON’T FOR A VARIETY OF REASONS INCLUDING INCOMPETENCE, RESOURCES, AND RUINING THEIR INTERNAL WAYS OF REGULATING. INCOMPETENCE IS AN EASY ONE – THEIR STAFF ARE MOSTLY TRAINED WITHIN AND ARE AMATEURS AT BEST. MOST DO NOT HAVE THE TRAINING OR SKILLS REQUIRED TO BRING FORWARD CRIMINAL ALLEGATIONS. PURSUING CRIMINAL CHARGES WOULD TAKE FAR MORE RESOURCES AND WOULD CUT INTO THE BCSC’S FANCY LITTLE BANK ACCOUNT – CRIMINAL LAWYERS ARE EXPENSIVE. AND FINALLY THE BURDEN OF PROOF IS FAR HIGHER IN A CRIMINAL MATTER AND WOULD BE ARGUED BEFORE REAL JUDGES AND NOT APPOINTED COMMISSIONAIRES. ALLEGATIONS IN MY CASE WOULD HAVE NEVER MADE IT INTO A REAL COURTROOM AS THEY WERE VERY CIRCUMSTANTIAL AND INACCURATE. SO CIRCUMSTANTIAL THAT THE LAWYERS HAD TO MANIPULATE EVIDENCE IN AN ATTEMPT TO PROVE THEIR FEEBLE CASE! TAKE A LOOK HERE!

- Courts make decisions about sentencing in criminal matters, not securities regulators. THIS IS EXACTLY MY POINT IN #5 ABOVE – REGULATORS ADMINISTER THESE HUGE FINES WHERE A REAL JUDGE WOULD NOT LEGALLY BE ABLE TO DO SO. I ALWAYS USE THE ANALOGY THAT IF A PERSON COMMITS A CRIME IN CANADA (SAY THEFT OVER $5000) – THIS PERSON IS GUARANTEED TO GET A FAIR TRIAL IN FRONT OF A JUDGE OR JURY, HE WILL NOT BE COMPELLED TO TESTIFY AGAINST HIMSELF, AND HIS PUNISHMENT WILL FIT THE CRIME ACCORDING TO LAW AND PREVIOUS CASE LAW. THIS IS NOT THE CASE WHEN A RESPONDENT IS FACED WITH ALLEGATIONS FROM A SECURITIES REGULATOR IN THIS COUNTRY. IN MANY (IF NOT ALL) RESPONDENTS ARE MADE TO ATTEND COMPELLED INTERVIEWS WHERE STAFF ARE ABLE TO ASK ANY QUESTION THEY WANT AND CAN USE THESE ANSWERS TO BRING ALLEGATIONS TO A HEARING ROOM. THE HEARING IS DONE IN FRONT OF BIASED, PAID COMMISSIONAIRES – IT IS NOT IN THESE COMMISSIONAIRES BEST INTEREST TO STAY CHARGES IF THEY WANT TO KEEP THEIR APPOINTMENTS(AND MONEY COMING IN). THE REGULATORS (SPECIFICALLY AT THE BCSC) HAVE ISSUED FINES THAT DO NOT SUIT THE LEVEL OF WRONGDOING. THAT CRIMINAL THAT WE MENTIONED ABOVE DOES HIS TIME AND HE IS RELEASED FROM PRISON AND IS INTEGRATED BACK INTO SOCIETY – THIS IS NOT THE CASE WITH THE BCSC. EVEN SOMEONE WHO COMMITS MURDER IN CANADA DOESN’T HAVE TO TESTIFY AGAINST THEMSELVES BECAUSE IT IS IN THE CHARTER OF RIGHTS AND FREEDOMS.

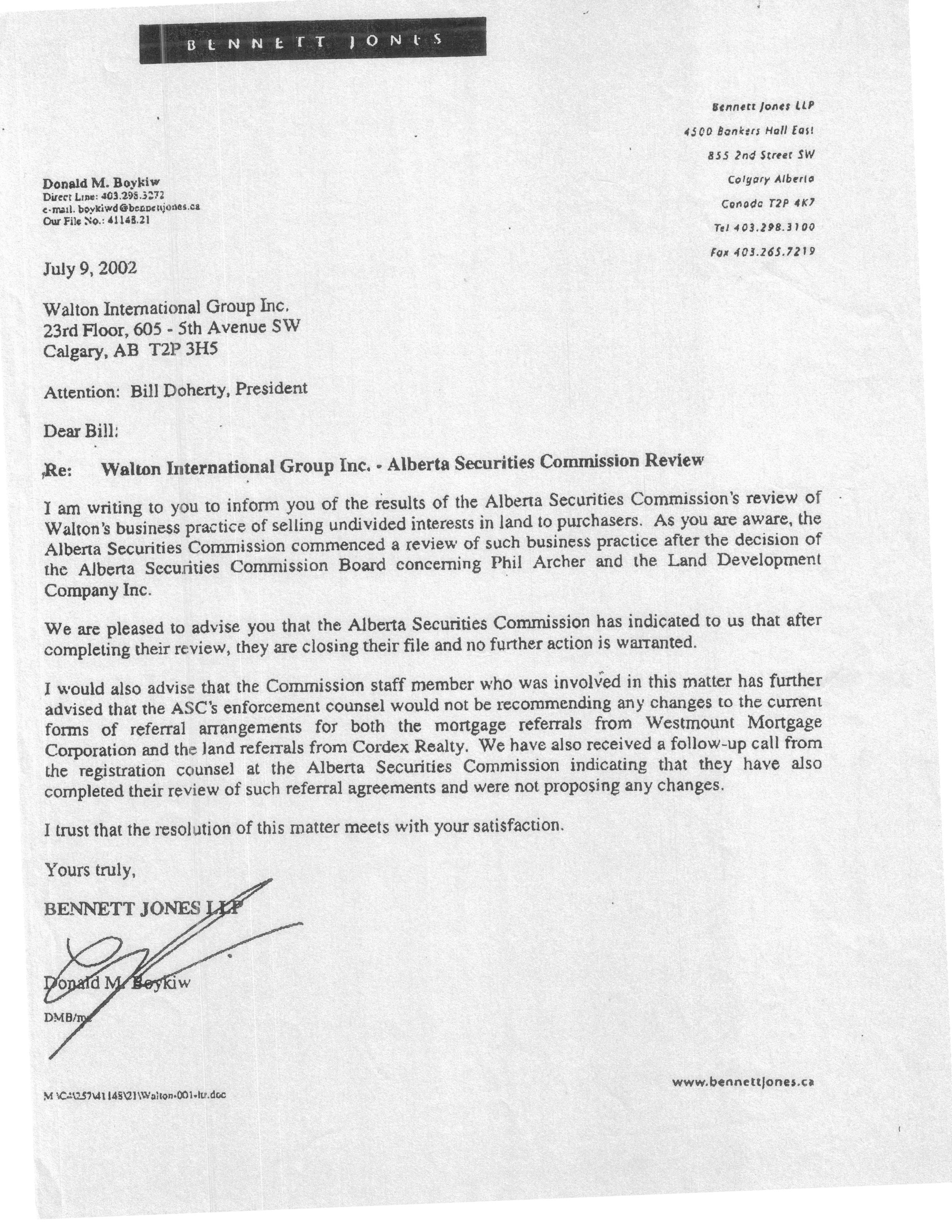

- The Globe notes that former Bank of Canada governor David Dodge spoke of the “widely held perception that Canadian authorities aren’t tough enough.” This quote was taken from a speech delivered 13 years ago in which the former governor actually said he was encouraged that provincial securities commissions were taking steps to toughen enforcement. THIS IS RATHER A MUTE POINT – WE WOULD AGREE WITH THE CSA WITH THIS COMMENT – IT IS RATHER OLD AND STALE. BUT WHAT ABOUT THE HUNDREDS (click on link) OF OTHERS THAT HAVE COMMENTED OVER THE PAST FEW YEARS, WEEKS, AND EVEN DAYS? WE POSTED THIS (click on link) TO OUR BLOG IN AUGUST 2016 WHERE EVEN THE FORMER HEAD OF THE ONTARIO SECURITIES COMMISSION WAS CRITICAL OF THE ACTIONS OF THE CSA. THERE ARE DOZENS OF COMMENTS ON THE INTERNET ON A REGULAR BASIS. IN A SIMPLE GOOGLE SEARCH WE HAVE FOUND DOZENS INCLUDING THIS VERY FUNNY ONE REGARDING THE FORMER CHAIR OF THE ASC….HE ACTUALLY HAD A SEX DOLL IN HIS OFFICE THERE ARE FACEBOOK PAGES, TWITTER PAGES, ETC. THAT HAVE ALL BROUGHT WRONGDOING BY REGULATORS TO THE FOREFRONT. FACTS ARE, THE REGULATORS HAVE DROPPED THE BALL FOR DECADES NOW. THIS IS BECAUSE NO ONE REALLY GOVERNS THEM – THEY ARE NOT ACCOUNTABLE TO ANYONE -ESPECIALLY NOT THE PEOPLE OF THIS COUNTRY!

- Securities regulators dedicate significant resources to helping investors protect themselves from fraud. These include local investor education initiatives, national campaigns about avoiding investment fraud, and a National Registration Search tool that investors can use to check whether an individual or firm is registered with provincial securities regulators. THAT’S GREAT! BUT AS WE CAN SEE FROM THIS ARTICLE – ONLY 4% OF THE ADVISERS CHECK OUT WERE REGISTERED WITH THE CSA! THIS MEANS THOUSANDS OF FINANCIAL PLANNERS IN CANADA ARE NOT REGISTERED – WHAT HAPPENS THEN? THIS DOES NOT EVEN ACCOUNT FOR THE WHOLE ADVISOR/ADVISER FIASCO THAT THE CSA AND THEIR PROVINCIAL PARTNERS HAVE CAUSED!

- The Globe has stated that its investigation is based on an analysis of 30 years of data contained in the CSA’s Disciplined List. This database does not contain 30 years of national data. Some securities commissions have uploaded data dating back just over 10 years. WHO CARES? YOU BOZOS ARE GRASPING! DOES IT REALLY MATTER WHEN IT ALL STARTED? THE SYSTEM IS BROKEN AND DATA WHETHER IT IS 30, 20, 10 OR EVEN 5 YEARS OLD DOES NOT LIE! YOU PEOPLE ARE MORE CONCERNED WITH PROTECTING YOUR BIG BUSINESS PARTNERS THAN PROTECTING THE AVERAGE CITIZEN! THINK I AM WRONG – PROVE IT! GET OFF YOUR ASSES AND MAKE THESE PROVINCIAL REGULATORS DO THEIR JOBS WHICH IS TO PROTECT THE PEOPLE OF THE PROVINCE USING FAIR, ETHICAL METHODS. STOP PAYING PEOPLE LIKE BRENDA LEONG $500,000 PER YEAR AND FIRE HER ASS OUT THE DOOR FOR INCOMPETENCE! CONTACT ME AND I WILL SHOW YOU HER COMPLETE AND SHAMEFUL HIGH-HANDED ACTS THAT WILL MAKE YOU HEAD SHAKE.

The CSA supports having a national dialogue about what more can be done to deter recidivists, however, that discussion must be based on facts and must involve all participants in the justice system, including law enforcement. WHAT’S STOPPING YOU?? COULD IT BE THE RACKET THAT THE PROVINCIAL REGULATORS CURRENTLY RUN BUCKSHOT OVER? SAD REALLY! YOU PEOPLE ARE ALL AT FAULT OF THE MESS THAT IS THE CANADIAN SECURITIES ADMINISTRATORS!