At the conclusion of our hearing, the Panel Chair NIGEL CAVE instructed both parties to complete Written Submission on Liability. These documents argued the points brought up during the hearing and gave the parties the ability to prove (or disprove) the allegations brought forward in the Notice of Hearing.

One of the key documents involved in the hearing was the Offering Memorandum(s) (“OM’s”) used by the Respondents to raise capital. For those that invested with the Respondents, you will remember this document as one you were given at the time you invested. The BCSC (and other securities jurisdictions) allow an OM Exemption when raising capital in the securities market.

On May 16, 2014, the Respondents received the Executive Directors Submissions on Liability and began reviewing the points brought forward by Staff. Staff Litigators Olubode Fagbamiye and C. Paige Leggat prepared the document on behalf of the Executive Director.

We read them from cover to cover a couple of different times and soon noticed something very particular….

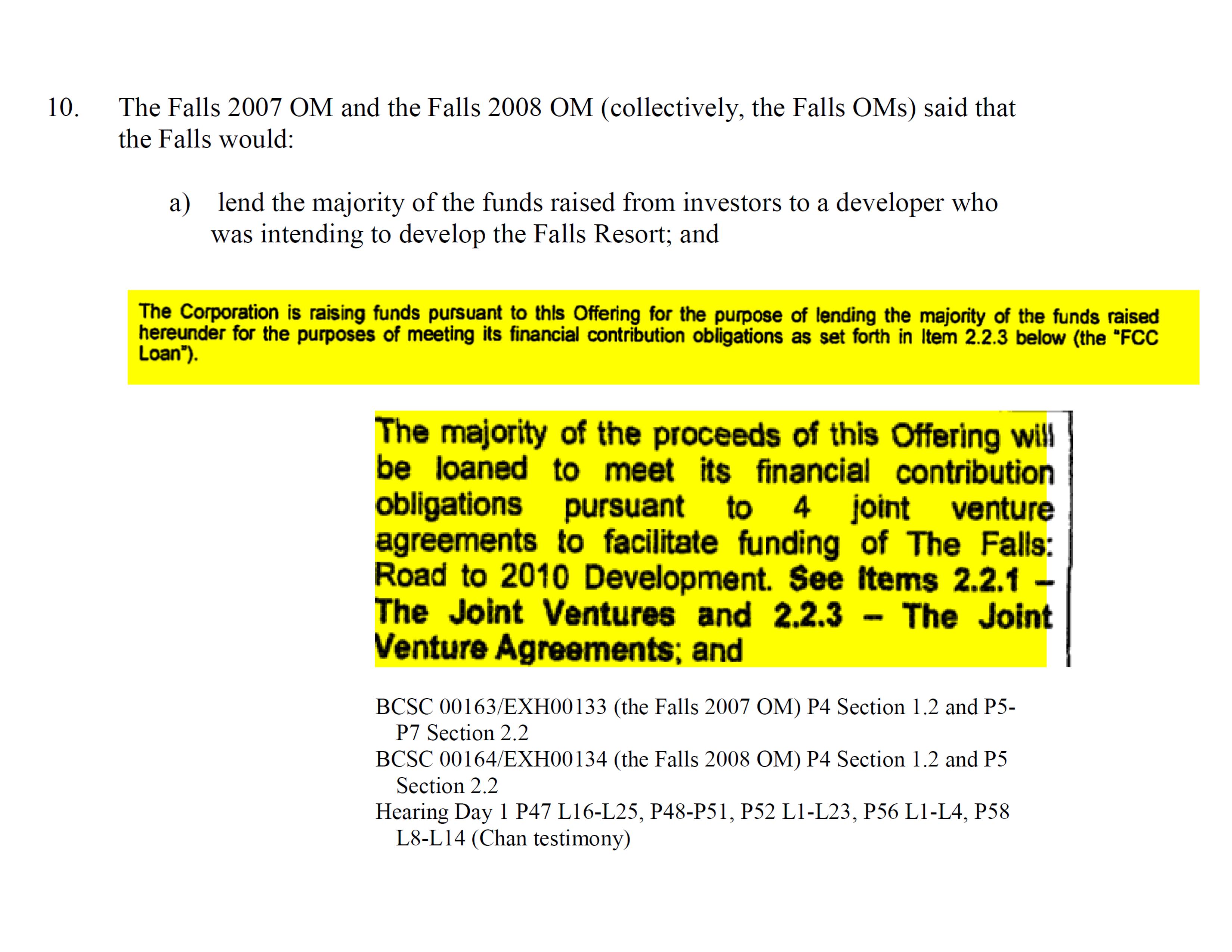

Unfortunately, at paragraph #10 of their submissions, Staff resorted to physically changing the appearance of the document. We feel they did this to suite their theory (and main allegation) that the Respondents did not forward the MAJORITY of the funds to the Developer. This was the big $5.45 million fraud allegation that was ultimately dismissed by the Panel. Let’s take a look at paragraph #10 as it appears in their submissions….

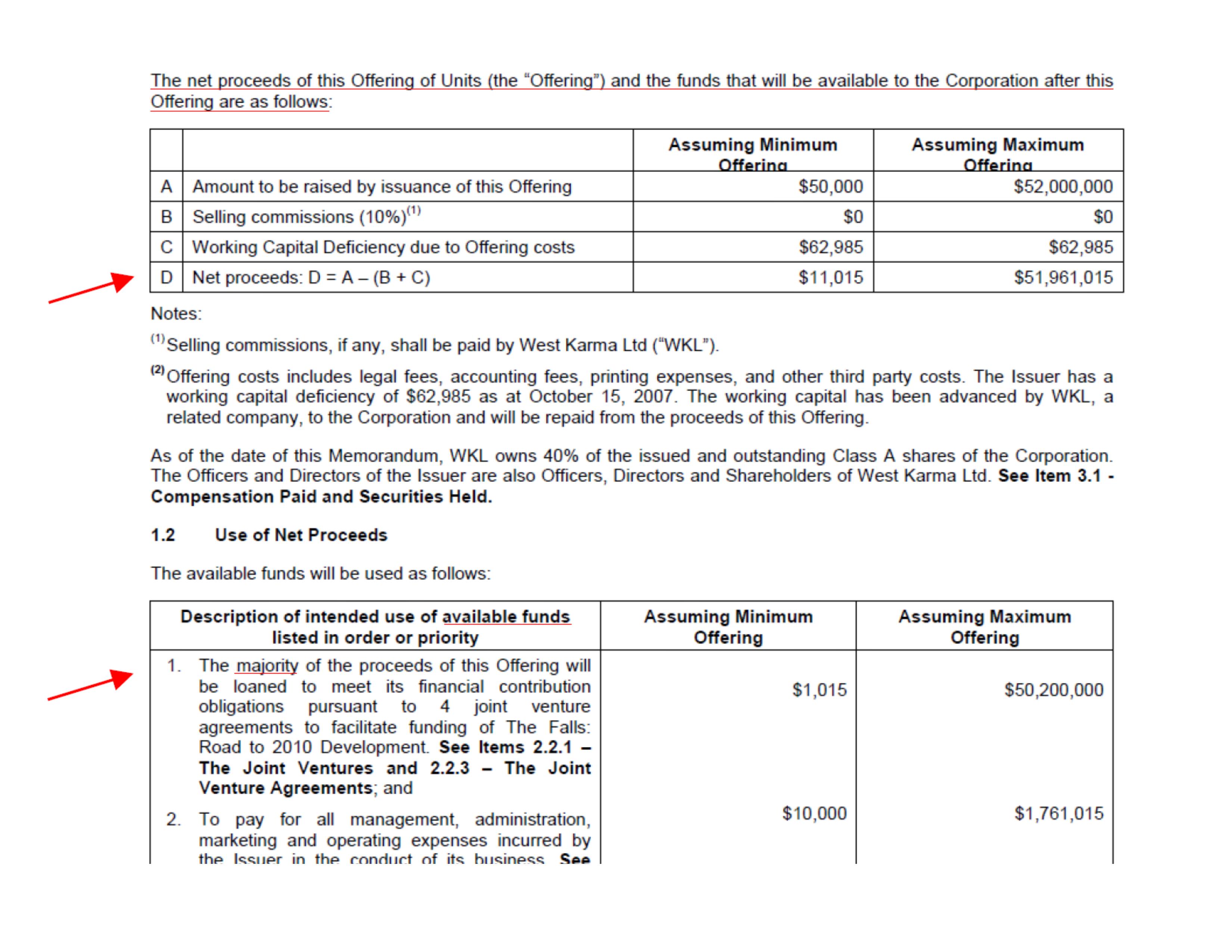

And now, for those of you that don’t have the FCC or DCF Offering Memorandums in front of you, this is how the document looked – keep in mind this document was relied upon at all times to raise capital for the projects, and Staff were suppose to have the onus of proving the case as alleged in the Notice of Hearing:

And now, for those of you that don’t have the FCC or DCF Offering Memorandums in front of you, this is how the document looked – keep in mind this document was relied upon at all times to raise capital for the projects, and Staff were suppose to have the onus of proving the case as alleged in the Notice of Hearing:

Staff (in paragraph 10) took Section 1.2 on page 5 of the FCC OM, merged it with Section 2.2 which is 2 pages later. They then highlighted both portions they manipulated (in yellow) to give an appearance that they were from the same section. In the first highlighted yellow box it states, “The Corporation is raising funds pursuant to this Offering for the purpose of lending the majority of the funds raised hereunder for the purpose of meeting its financial contribution obligations as set forth in item 2.2.3 below (the “FCC” Loan”). The catch here though is they placed the portion from 2.2 above section 1.2 in their submissions. Section 2.2 includes the word ‘hereunder’ which the reader would automatically think was the second yellow highlighted box. The second box then uses the words “majority of proceeds” and “financial obligations”. They complete their manipulation by omitting the title “Use of Net Proceeds” all together.

For those of you that do not understand the significance of these actions of Staff, we will try to explain it this way…originally when the Executive Director brought forward the allegations of fraud, they took a simple grade 2 math equation (the amount of the cheques written to the developer AND the amount of commission paid to sales people were subtracted by the total amount of funds raised). They did not consider ANY other of the valid business expenses incurred by the corporation that were allowed under the OM’s. In their allegations, they stated the Respondents did not advance the majority of the funds to the Developer which was wrong! The Respondents (who did not have a lawyer) proved this allegation to be wrong by repeatedly asking the Lead Investigator (the flunky Elizabeth Chan) questions during the cross examination. It is VERY apparent that Staff relied on basic, summary evidence that was only a small portion of the actually story – these were very complex, intertwined companies and Staff had all the information (bank records, credit card statements, etc.) but failed to bring strong compelling evidence to the hearing.

To this day, we are not sure why Staff’s Bigshot Litigators felt they needed to manipulate the evidence they had before them. We have had people speculate that once the hearing was over they realized their case was not as strong as they had once thought so they needed to resort to something like this. That maybe because the Respondents were self-represented, they thought they might be able to sneak this past.

Either way, this shows the playing field one faces when going against an internally run regulator. Nobody seems to be accountable – as an example, during the hearing the Respondents asked repeatedly (IN FRONT OF THE PANEL) for the litigator (Olubode Fagbamiye) to explain his actions to which he did not even acknowledge the question. We still question WHY the Panel Chair did not stop the proceedings and ask the litigator IF my our allegations were true and/or WHY they did this. The Commission for intense and purposes appears to be a Kangaroo Court – where the judge, jury and executioner all work in the same office space.

Interesting enough, right after the Respondents submitted their Reply Submissions on Liability (in July 2014 where we accused them of manipulating the document) the other Staff Litigator who’s name is on the document (C. Paige Legatt) resigned. She resigned and we have never had the chance to ask her whether or not she takes credit for manipulation. Again, what are these people hiding? Complete scumbags! If they would have come in with a reasonable number there is a great chance we would have been able to negotiate a settlement and could have had our investors participate in the Deercrest development without any involvement from us.

Shame on the BCSC!!